The Ultimate Taste Of Luxury: Wine

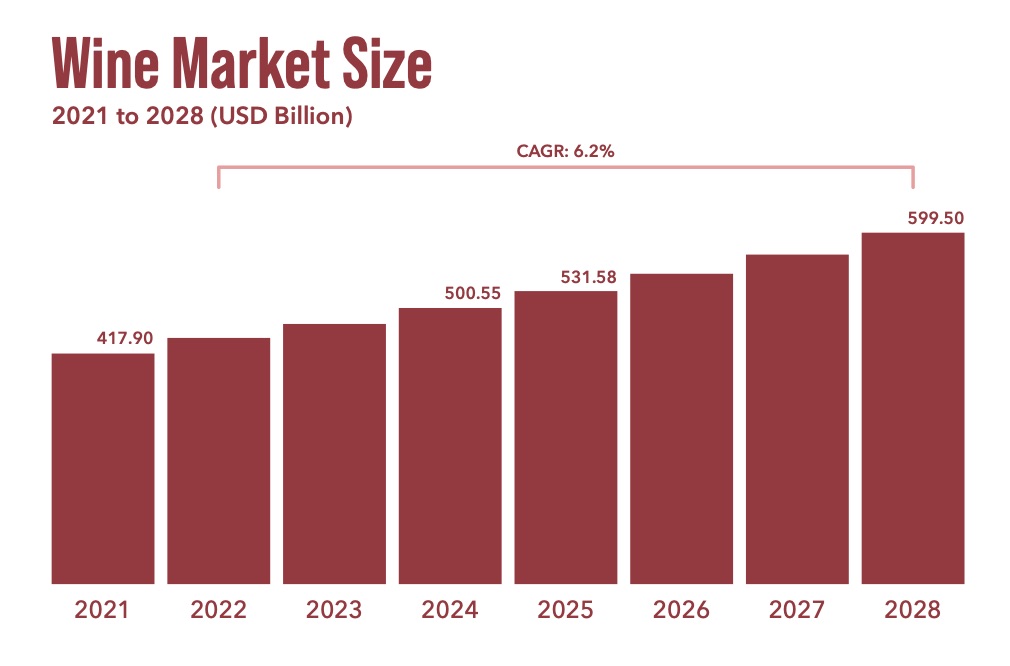

Fine wine is widely considerable the ultimate taste of luxury, serving as a universal symbol of status that stretches across cultures to offer a shared escape to discerning palates in every corner of the globe. Premium bottles are masterpieces that transcend the liquid contained within, blurring the line between spirit and art. These characteristics have yielded fervent passion among wine enthusiasts that only continues to rise, and with it the demand for premium selections has dwarfed available supplies. There’s no question, the demand for fine wine won’t be declining any time soon.

How Does Wine Investment Stack Up?

Fine wine has shown exceptional stability and consistency in performance over the long-term.These characteristics make fine wine an important holding for strategic investors looking to diversify their portfolio with an asset that offers unparalleled resilience across economic cycles.

Wine prices rose by 13% in 2021, with average growth of 11.90% per annum over the past 10 years. The level of appreciation varies vastly based on the winery, region and vintages selected. While certain bottles may vastly exceed this level of performance, by selecting a balanced portfolio investors can achieve a greater level of stability.

Of particular significance, this appreciation has statistically been un-correlated to the stock and bond markets. This is an important consideration for investors seeking a diversified portfolio as cross-asset correlations have more than doubled over this time period.

Winery Direct Relationships

By working directly with wineries, investors are protected by guaranteed provenance and authenticity for every investment. Upon acquiring a portfolio of bottles they are either stored directly at the winery or transferred directly from the winery to a secure third party facility. In either instance the chain of custody is carefully controlled and documented, eliminating the need for extensive verification being required prior to bottles being resold to another buyer.

Investors also benefit from avoiding redundant markups which can permeate through secondary market purchases. This yields investment portfolios with a lower cost basis thereby positioning each investment for higher returns.

Stringent Oversight & Investor Protections

In the United States all wine production falls under the three tier system whereby every winery must receive a federal license before production can begin. Upon receiving the license the winery must comply with strict laws governing production, storage, transportation and bottling of all spirits. Wineries are careful to always ensure compliance due to the significant penalties levied for any discrepancies. When combined with the safeguards put in place by the SEC, FDA and other governing bodies, the United States is arguably the most secure market for wine investors.

Request Access To Current Wine Investments

Enter your information to receive access to available wine investment portfolios.