Start building your wine investment portfolio today.

Unlock the power of a tangible asset that is un-correlated to traditional financial markets. Wine investment offers an unprecedented level of wealth security combined with a history of consistent returns across economic cycles.

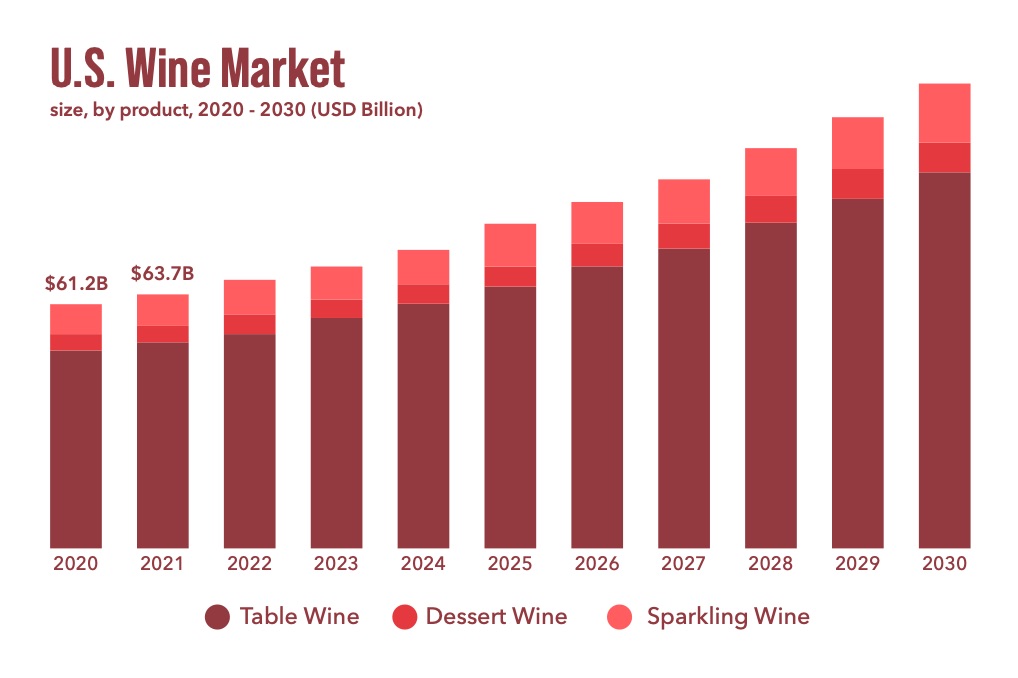

The above graph demonstrates the overall growth in the United States wine market and projected future growth through 2030, as per Grandview Research.